Methodology

Data Ingestion and Review Process

ReFED has developed an automated web application that runs in the background to assist in the ingestion, review, and maintenance of investment data for the Capital Tracker. The foundation of the automation process is built around a set of keywords that can be grouped into two types:

Solution Provider Keywords: Based on the name of known food waste solution providers (e.g., “Spoiler Alert”), ReFED has developed a list of keywords that indicate a particular investment was distributed to a predetermined list of providers, many of which are included in ReFED’s Solution Provider Directory <https://insights-engine.refed.org/solution-provider-directory?sort_by=asc%28name%29>`[:ref:`3<_capital_tracker_works_cited>], which includes over 1,000 providers offering products and services to help reduce food waste.

“Regular” Keywords: Based on terms that people use to describe topics that ReFED has determined are either directly or indirectly related to food waste reduction (e.g., “food waste”, “compost”, “animal feed”). See the previous Scope section for more information on which topics ReFED considers to be in scope.

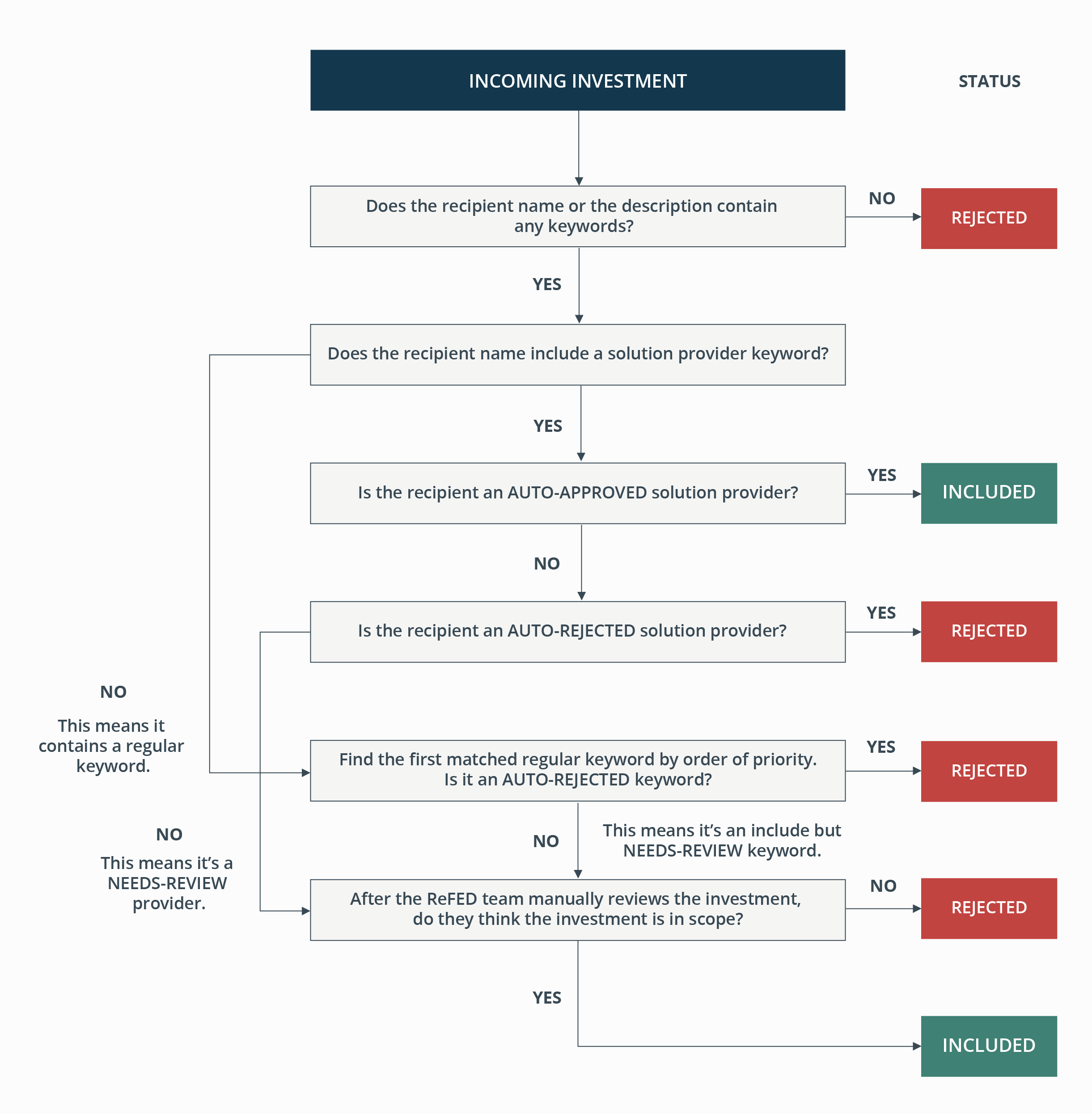

The automated system intakes newly posted investment data on a monthly basis from a variety of data sources and runs each investment through the decision tree displayed in Figure 2. In cases where an automated decision cannot be made about whether to include or reject the investment, the recipient, and ultimately the investment, is manually reviewed by a ReFED staff member. Standard information attributes (listed in Table 4) are collected and stored for each investment that is ultimately included and accepted into the Capital Tracker.

Figure 2. ReFED Decision Tree and Review Process for Inclusion of Investments in the Capital Tracker

ATTRIBUTE |

DESCRIPTION |

EXAMPLE |

|---|---|---|

Amount |

U.S. Dollar Amount of transaction |

$100,000 |

Deal Date |

Date the transaction took place. For private foundation grants, only the fiscal year is available.

|

11/1/2012 |

Recipient |

The entity receiving the capital |

Apeel |

Funder |

The entity providing the capital |

Bill & Melinda Gates Foundation |

Description |

A brief description of the the investment

|

The company raised $100,000 of grant funding from Bill & Melinda Gates Foundation in November 2012.

|

Capital Type |

ReFED maintains a hierarchical classification of capital types:

• Capital Type: Higher level groups of philanthropic, government, and private capital.

• Funding Group: Further segmentation of Capital Types to the following groups - tax incentives, government grants, nongovernment grants, impact-first investments, venture capital, private equity, corporate finance and spending, commercial project finance, government project finance. These groups are described in detail in the Solution Database Methodology.

• Investment Type: Provides further detail as to the nature of the transaction.

• Detailed Investment Type: Provides further detail as to the nature of the transaction.

See Appendix A for the full classification hierarchy.

|

Philanthropic

Non-government Grants

Grant

n/a

|

Solution Type |

ReFED maintains a hierarchical classification of food waste solution types:

• Solution Group

• Action Area

• Solution Name

NOTE: It is important to note that depending on who the recipient of the investment is and depending on the information provided in the investment description, it is often not possible for ReFED to tag an investment with an individual food waste solution. In cases where it is clear that the investment is for food waste, but the exact topic area is not specified, ReFED tags investments with more general Solution Type categories such as “General” or “Prevention”. This does make it difficult to use the Capital Tracker dataset to quantify exactly how much capital has been invested in a particular solution.

See Appendix B for the full list of food waste solutions

|

Prevention

Maximize Product Utilization

Edible Coatings

|

Applicability |

Whether an investment is directly or indirectly related to food waste:

• Direct: Explicitly funding food waste initiatives. ReFED rule of thumb is that organizations/initiatives receiving funding should be >50% related to food waste diversion or reduction.

• Indirect: Funding that is not explicitly for food waste initiatives. ReFED’s general rule is that if an organization is >20% but less than 50% of operations devoted to food waste, it is considered indirect; the same logic is applied to individual investments.

See the Scope: Thematic Funding Areas section for more information about which topics are considered Direct versus Indirectly related to food waste.

|

Direct

|

Data Source |

Source from which the investment information was obtained

|

PitchBook

|

Link |

If available, a website link to more information about the investment straight from the Data Source

|

N/A

|

Data Sources & Limitations

PitchBook is a financial data and software company that maintains a curated database and analytical tools to explore investments in public and private equity markets, including venture capital, private equity, and mergers & acquisitions. ReFED subscribes to a curated, weekly data feed of food waste related investment data from PitchBook based on a list of predetermined food waste solution providers using the keyword approach described in the previous section. While no data source is perfect, and occasionally there are investments that are missed, PitchBook is very thorough and maintains high, people-based quality assurance standards as opposed to automated web scrapers provided by others. After reviewing PitchBook’s data and comparing it to others, ReFED found the PitchBook dataset to be of the highest quality for the purposes of tracking U.S. private investment.

INVESTMENT TYPE |

DESCRIPTION |

|

|---|---|---|

PRIVATE CAPITAL: VENTURE CAPITAL |

||

Accelerator/Incubator |

An event where a company joins a temporary program that variably provides

funding, office space, technological development, and/or mentorship. Often in

exchange for equity in the company. PitchBook’s tracking criteria only includes

accelerators/incubators that take equity or give a cash disbursement as part of

the program.

|

|

Angel (Individual) |

When a high net-worth individual provides capital to a company in its early

stage in exchange for a minority stake. The investment must come directly from

the individual’s own funds and not from any other source.

|

|

Capitalization |

When the founders, owners or upper management of a company need initial

funding and use their own money to provide the financial backing. This deal

type is often called bootstrapping.

|

|

Accelerator/Incubator |

An event where a company joins a temporary program that variably provides

funding, office space, technological development, and/or mentorship. Often in

exchange for equity in the company. PitchBook’s tracking criteria only includes

accelerators/incubators that take equity or give a cash disbursement as part of

the program.

|

|

Angel (Individual) |

When a high net-worth individual provides capital to a company in its early

stage in exchange for a minority stake. The investment must come directly from

the individual’s own funds and not from any other source.

|

|

Capitalization |

When the founders, owners or upper management of a company need initial

funding and use their own money to provide the financial backing. This deal

type is often called bootstrapping.

|

|

Early Stage VC |

An early stage round of financing by a venture capital firm in a company. Early

stage is usually a Series A to Series B financing deal and occurred within 5 years

of the company’s founding date. If there is no series associated with the deal

and the deal occurred within 5 years of the company’s founding date, we also

categorize the deal as early stage VC

|

|

Equity Crowdfunding |

Financing received from a crowdfunding platform where individuals provide

venture or growth funding through the purchase of the target company’s

equities.

|

|

Late Stage VC |

A later stage round of financing by a venture capital firm into a company. Later

stage is usually Series B to Series Z+ rounds and/or occurred more than 5 years

after thecompany’s founding date.

|

|

Product Crowdfunding |

Financing received from a crowdfunding platform through which individuals

have provided non-equity funding in exchange for companies’ products,

generally before they have been released to the market.

|

|

Seed round |

When any investor type provides the initial financing for a new enterprise that is

in the earliest stages of development. PitchBook will only designate an equity

raise as seed financing when it’s explicitly referenced as a seed deal in sources.

|

|

PRIVATE CAPITAL: PRIVATE EQUITY |

||

Buyout/LBO |

Purchase of at least a controlling percentage of a company’s capital stock* by a PE firm to take over its assets and operations. A leveraged buyout (LBO) involves borrowing money to finance a portion of the purchase price.

*On a fully diluted basis.

|

|

Mezzanine |

Mezzanine debt has lower priority than senior debt but usually has a higher

interest rate and often includes warrants. This debt type also often involves

taking a small portion of equity in the target company.

|

|

PE Growth/Expansion |

When a private equity firm makes a non-control, equity investment in a

company. Cash is received by the company and not the selling shareholders.

|

|

Platform Creation |

When a private equity team provides the initial capital for the creation of a new

company.

|

|

PRIVATE CAPITAL: CORPORATE FINANCE & SPENDING |

||

Bankruptcy: Liquidation |

A bankruptcy proceeding in which a company stops all operations and goes

completely out of business. A trustee is appointed to liquidate (sell) the

company’s assets and the money is used to pay off debt.

|

|

Corporate |

When a Corporation injects capital into a private company in exchange for

newly issued shares of that private company.

|

|

Corporate Asset Purchase |

When a Corporation acquires a majority stake (>50%) of the equity in an asset.

For details, see the article Corporate asset purchase

|

|

Debt - General |

Transactions where the primary source of financing is debt. |

|

Debt - PPP |

Paycheck Protection Program Loans are a U.S. Small Business Administration (SBA)

loan that’s meant to help businesses keep their workforce employed during the

Coronavirus (COVID-19) crisis.

|

|

Debt Refinancing |

The borrower obtains a new loan with better terms than their existing loan and

then uses the new loan to pay off the original loan.

|

|

Debt Repayment |

Payment of debt obligation. |

|

IPO |

An investment open for the general public or retail investors after the company

has complied with the registration requirements of new securities laid down by the

security & exchange commission.

|

|

Joint Venture |

When two or more companies develop a new entity or asset by contributing

existing assets, funding, etc for a stake in the new entity/asset.

|

|

Merger/Acquisition |

When a corporation acquires at least a controlling percentage of a company’s

capital stock in another corporation. This deal type is often called a strategic

investment

|

|

Out of Business |

Company stops all operations and goes completely out of business |

|

PIPE |

When a private investor (such as a private equity firm) makes a non-control equity

investment in a publicly-traded enterprise through the acquisition of securities

issued directly by the company.

|

|

Public Investment 2nd Offering |

The issuance of new stock for public sale from a company that has already made

its initial public offering (IPO)

|

|

Reverse Merger |

When a public company is acquired by a private company, allowing the private

company to bypass the usually lengthy and complex process of going public.

EX: Company A acquires Company B and after acquisition Company A dissolves.

|

|

PRIVATE: OTHER |

||

Secondary Transaction - Open Market |

A transaction where the holders of stock sell their shares on a publicly-traded

exchange or a private secondary purchase marketplace.

|

|

Secondary Transaction - Private |

An investment where one investor buys a minority equity interest in a target

company directly from another investor.

|

|

Share Repurchase |

Management repurchases shares from shareholders, often in an attempt to

bolster share price by reducing supply.

|

|

Undetermined |

Catch-all for deals that are not able to be classified. |

|

Since July 1, 2019, the IRS has required private foundations that file at least 250 returns annually to electronically file their annual 990-PF form. This form includes a section where foundations are required to list any grant distributions made during the fiscal year including the grant recipient, the amount disbursed, and a brief description of the purpose of the grant. The IRS makes all e-filed 990-PF forms publicly available online in XML format. ReFED’s automated systems scans these XML documents on a monthly basis looking for grants that might be food waste related.

Prior to July 1, 2019, many foundations had already made the shift to electronic filing as opposed to conventional paper-based filing, although there were some holdouts. In the past, if a foundation did not e-file their 990 form, the only way for the public to access the forms in bulk was through third party websites such as Candid (formerly known as Foundation Center) or the Propublica Nonprofit Explorer. In the past, ReFED used both of these data sources to supplement the e-filed 990-PF XML data in order to comprehensively track food waste investment and identify food waste related grants from organizations that chose not to e-file.

Limitations of Keyword Approach for Foundation Grants

As previously mentioned, 990-PF forms include a section that requires foundations to list any grant distributions made during the fiscal year including the grant recipient, the amount disbursed, and a brief description of the purpose of the grant. ReFED’s automated keyword scan searches the recipient name and the grant description for any matches, but sometimes the descriptions are very limited (Sometimes they are blank, and other times they only say “General Support”). This means that the keyword scan is only as good as the recipient name and description given, which can lead to missed grants. Because ReFED has a large network of foundations and solution providers, sometimes these misses are identified and self-reported. So sometimes you might come across an investment in the Capital Tracker where the data source says “Self-reported”.

Only Private Foundations File the 990-PF

There are other types of philanthropic entities that provide Non-Government Grants (high-net-worth individuals, donor advised funds, etc.), but only Private Foundations are required to file the 990-PF form. This means that grants provided by these other types of entities are not captured by the automated data ingestion process.

Time Lag of Reporting

Even with extensions, private foundations must file the 990-PF within 12 months of the end of their fiscal year. This can, however, lead to up to a two-year time lag between when grants are distributed and when they are reported to the IRS. For example, a foundation could disburse a grant contribution on January 1, 2022. If their fiscal year ends on December 31, 2022, that means they have until December 31, 2023 to report that grant. Currently there is a greater than usual time lag due to service disruptions to the IRS resulting in a three year lag. The latest complete year is 2019, however data for more recent years is now being made available.

Lack of Disclosure By Date

990-PF forms do not indicate when a specific date grant is distributed. System assumes and displays IRS grants for January 1 of the filing year.

Review Process

As outlined in Figure 2, ReFED follows a decision tree process in order to determine if a grant is within scope of food waste. In practice, reviewing philanthropic data differs from private data (PitchBook) in that the assessment does not start at the recipient level. For philanthropic data, ReFED starts by reviewing grant descriptions in order to determine if they are within scope of food waste and applicability (Direct or Indirect).

When the grant description does not provide enough information, then the team assesses the recipient of the grant. Based on the nature of the organization’s mission, technology, sector, operations or if the activities could be classified within ReFED’s food waste solution categories. For example, most grants to food banks and food pantries have been classified as “indirect” (which make up the bulk of philanthropic indirect funding), since some funded activities relate to food recovery, but much also involve food purchases.

Data Ingestion

ReFED has limited the data set to grants that are $5,000 or greater in size as these would be indicative of foundation giving versus smaller amounts would be more akin to individual giving.

The automated system intakes newly posted grant data on a monthly basis. There are cases where a file may include a transaction already in the backend. If the transaction has a number of matching fields (same funder, recipient, dollar amount, description, and date), the system will treat this as a duplicate and not import it.

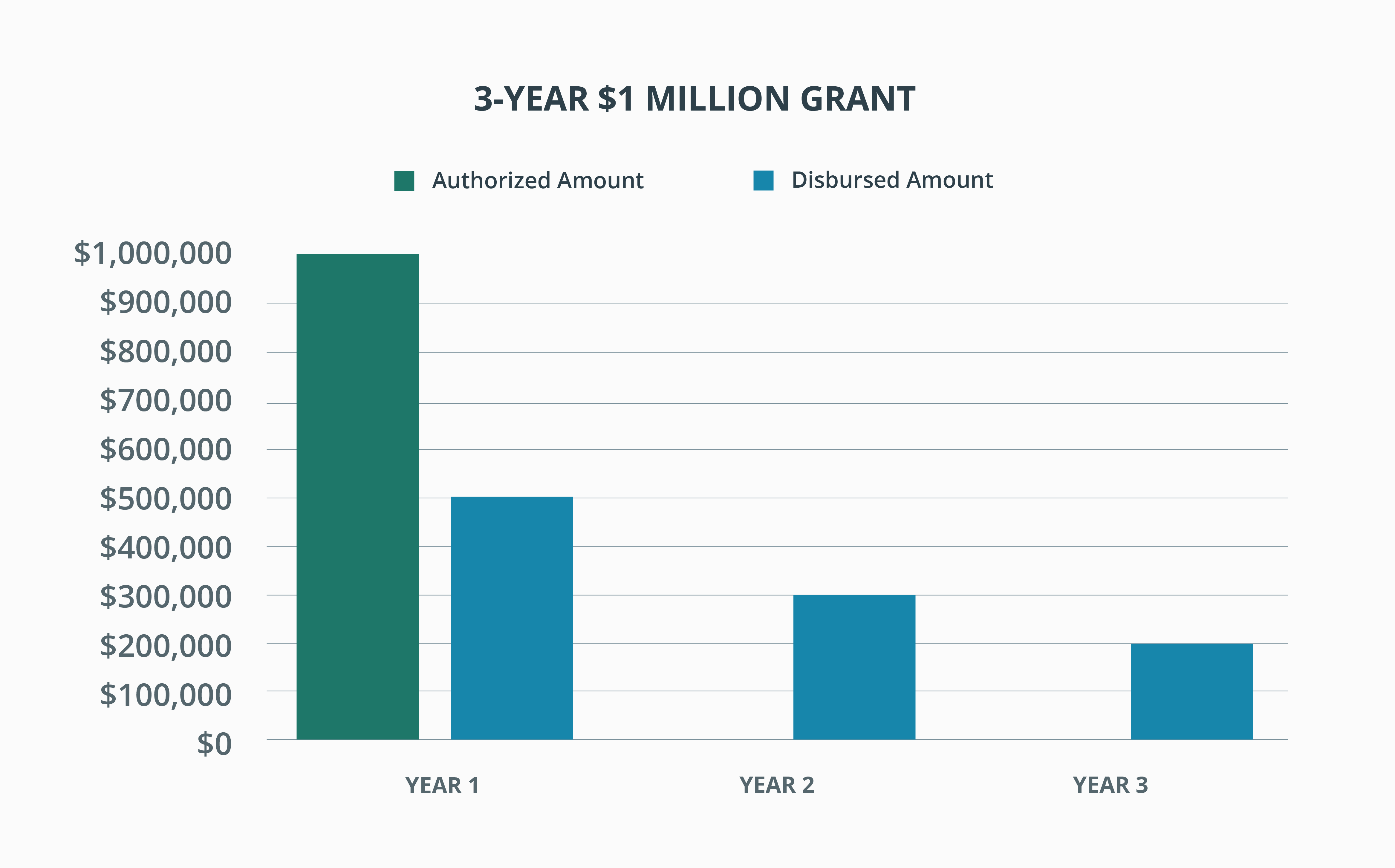

Grant Authorized Amount versus Disbursed Amount

For multi-year grants, there is a difference between the full grant authorized amount versus the disbursed amount, which is how much is paid out each year to the recipient. Form 990-PF’s capture the yearly disbursed amount, so the disbursed amount is what is listed for all grants where the data source is the e-filed IRS forms, as is the case for the majority of philanthropic investments. This does vary, however, when the data source is Candid or when the investment is self-reported. Candid’s self-reporting programs typically capture the authorized amount, as this is what participants typically provide through the manual process. Similarly, when funders or recipients notify ReFED of a food waste investment that hasn’t already been identified, it is usually the authorized amount that they provide.

Figure 3. Illustration of Grant Authorized Amount Versus Disbursed Amount